Context

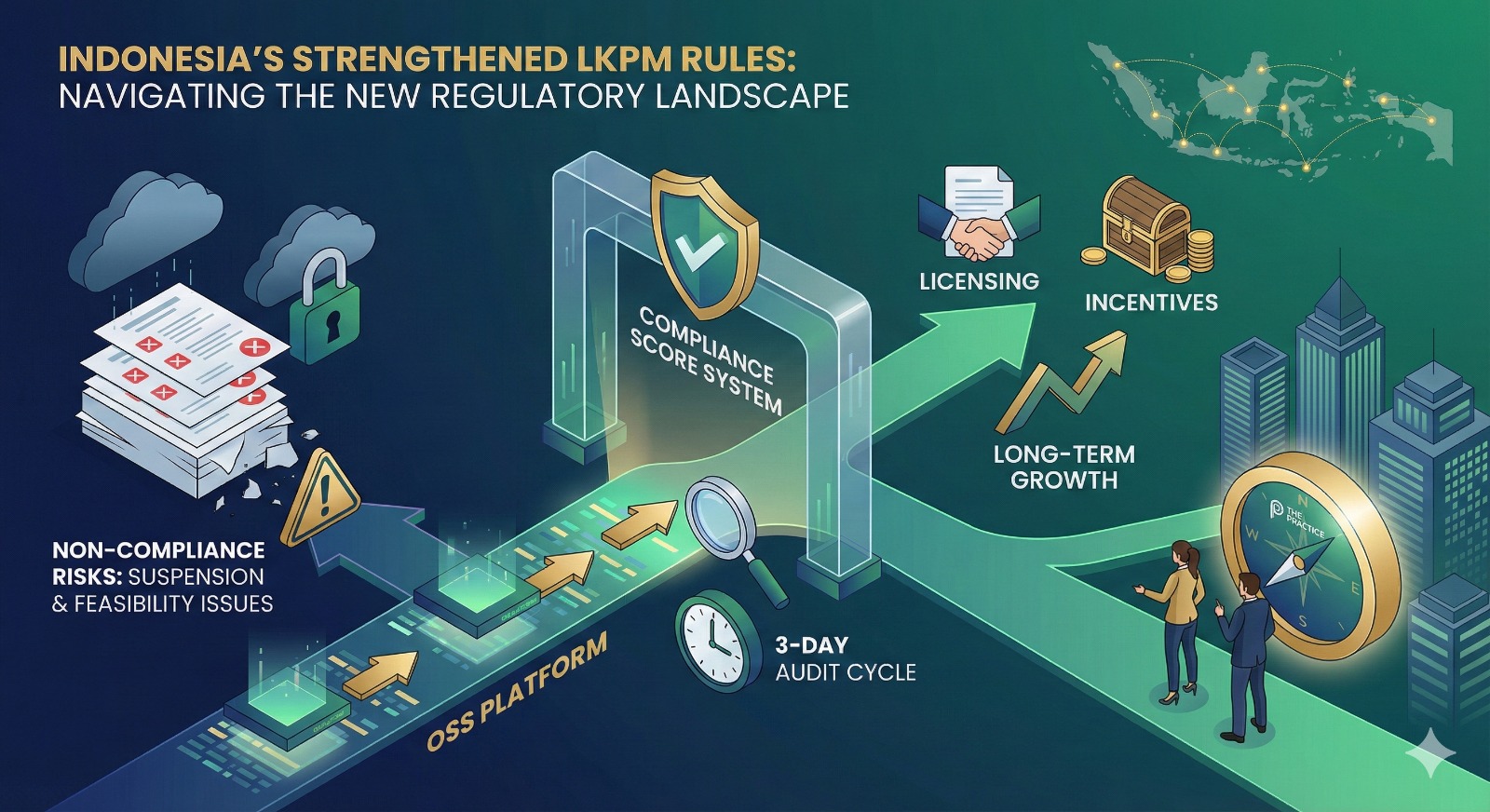

Indonesia has strengthened LKPM (Investment Activity Report) rules for all companies operating in the country. The updated regulations emphasize transparency, compliance, and accurate reporting through the OSS platform.

Significance

The revised LKPM framework significantly raises the bar for transparency, accuracy, and accountability. Key changes include:

- Introduction of a formal legal compliance scoring system for companies

- Mandatory audit of each LKPM submission within three working days

- Closer integration between LKPM data and business licensing, incentives, and supervision mechanisms

These measures reflect the government’s broader push to improve regulatory oversight, investment data quality, and enforcement credibility — particularly amid heightened scrutiny of investment realization figures.

Implications

For businesses, LKPM is no longer a procedural obligation but a regulatory risk touchpoint. Key implications include:

- Higher compliance exposure: Errors, delays, or inconsistencies can trigger formal warnings, operational suspension, or questions over business feasibility.

- Licensing and incentives at stake: LKPM performance now directly influences access to permits, fiscal incentives, and future approvals.

- Tighter timelines: With audits conducted within three working days, companies have limited room to correct inaccuracies after submission.

- Internal alignment pressure: Finance, legal, operations, and government relations teams must coordinate more closely to ensure accurate reporting.

For foreign investors in particular, weak LKPM compliance may affect long-term regulatory standing and investor confidence.

Conclusion

Indonesia’s strengthened LKPM regime signals a clear policy direction: investment activity must be verifiable, compliant, and transparent.

While the reforms aim to improve governance and data integrity, they also raise the cost of non-compliance. Companies that continue to treat LKPM as a box-ticking exercise risk facing operational and licensing consequences.

In this new environment, LKPM compliance has become a strategic regulatory issue, not merely an administrative one.

Recommendations

To adapt to the updated LKPM framework, companies should:

- Review internal LKPM reporting processes to ensure accuracy and consistency

- Align OSS data with actual operational and financial records

- Monitor compliance scores and audit feedback closely

- Seek professional regulatory guidance to mitigate compliance risks

- Engage early when discrepancies or reporting challenges arise

Need Regulatory Assistance?

The Practice is here to assist you , from LKPM compliance reviews to OSS strategy and regulatory risk management.